Contents

A good exchange you can use in Canada is Binance. Cointox and Mercatox are other good alternatives to Binance. Check below for steps to buy the cryptocurrency on Binance. Both notices were dated December 13, 2021 with payments due on January 3, 2022—more than a month ago.

- Are there any limits on the amount you can deposit into your account or the amount of cryptocurrency you can buy or sell per transaction or per day?

- You need to buy Tron from exchanges before you can start Tron day trading.

- On his last “I need another five to seven minutes” he said he was close to having this resolved.

- But when clients who thought they had purchased BTC tried to access their funds, they discovered their money had vanished.

There was no insert giving the taxpayer more time to pay. It appears the IRS again has a backlog of notices to be mailed, and is sending out notices late. Listen to TIGTA and spend what technology money you have wisely. Yesterday, TIGTA released a report noting that the IRS cost the US $56 million mercatox review in interest payments because of outdated mail processing equipment that would cost between $360,000 to $650,000 to replace. I’m in the Pacific time zone, so when I call at 7am , I’m competing against everyone else in the US. On Monday I couldn’t get through to the Practitioner Priority Service .

Taxable Talk

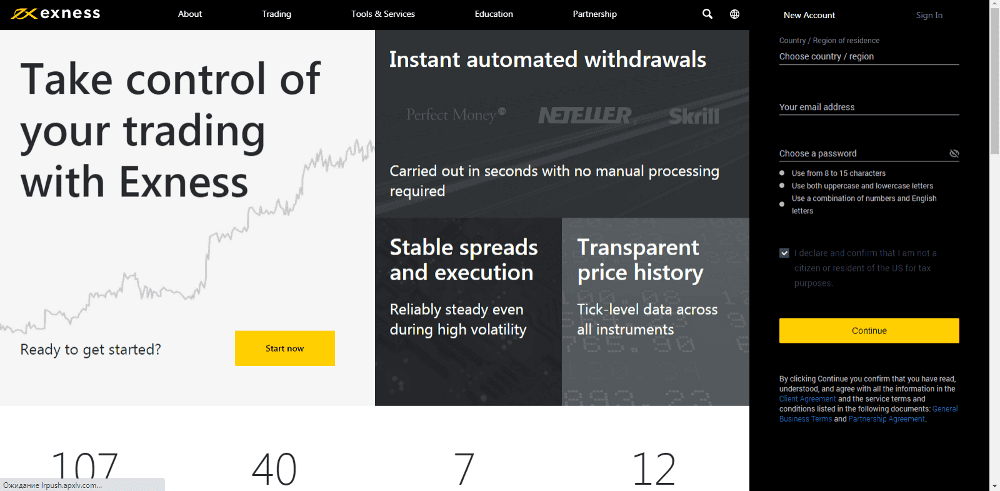

Cryptocurrency trading platforms (suited to beginner/intermediate users). Buy and sell cryptocurrency on an open market for competitive fees, a wide selection of cryptocurrencies and optional features like margin trading. Many exchanges now offer brokerage services to be more beginner-friendly. Each year, we conduct an extensive review of the crypto exchanges and trading platforms available in Canada. To arrive at these picks, we evaluated more than 25 platforms on user experience, fees, payment methods, selection of coins and more.

Believe it or not, Ralph may still have to register for sales tax in Pennsylvania. Under the Wayfair Supreme Court decision, out-of-state sellers are, in some circumstances, required to register for sales tax in other states . Let’s further assume that Ralph doesn’t meet that threshold. In that case, Linda owes use tax (the equivalent of sales tax when sales tax isn’t charged) to Pennsylvania and must include it on her individual tax return.

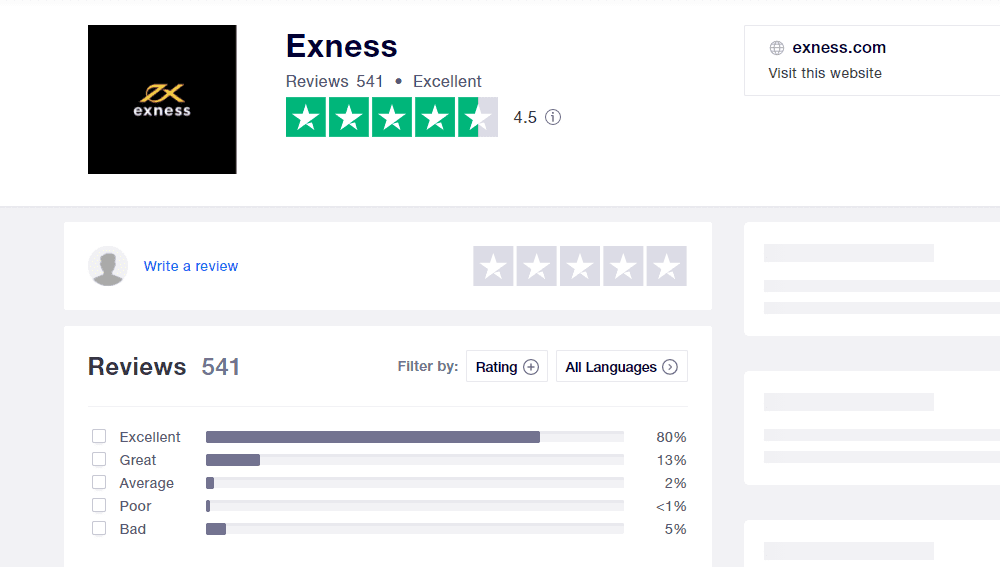

While we are independent, we may receive compensation from our partners for featured placement of their products or services. NDAX is a Canada-based digital asset exchange with CAD currency pairs and with options for advanced traders. You can also read our dedicated review for each exchange or see what other users think of the platform using a third-party service like Trustpilot. If you are looking to earn a yield on your cryptocurrency, you can do so through exchanges that offer earning options. Certain exchanges allow you to either lend or stake your cryptocurrency as a means to earn a yield on it.

Locked staking is a form of staking in which you earn a yield for helping to secure a blockchain network. DeFi staking includes lending assets to peers or to a decentralized exchange to earn a yield. NDAX won our award for best homegrown Canadian crypto exchange because of its low trading fees, its security and its easy-to-use interface. It’s quick and straightforward to create an account on Netcoins. And with just a few clicks, you can purchase over 30 different digital assets.

BTC/USD Bitfinex Overview

All forward-looking statements are inherently uncertain as they are based on current expectations and assumptions concerning future events or future performance of the company. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. In evaluating such statements, prospective investors should review carefully various risks and uncertainties identified in this release and matters set in the company’s SEC filings. These risks and uncertainties could cause the company’s actual results to differ materially from those indicated in the forward-looking statements. The Paycent card offers a cashback program, Cash-back on PYN HODL from 20th Mar 2019.

Foreign cryptocurrency exchanges with just cryptocurrency do not have to be reported on the FBAR. However, if the account holds anything else (such as ‘fiat’ currency like US dollars, Euros, etc.) the account is reportable. Not all crypto exchanges are created equal and not all crypto buyers and sellers have the same trading needs. The best exchange or platform for one person might not necessarily be the right choice for someone else, so it’s essential to do your own research. Compare cryptocurrency exchanges to find one that offers the right service for you.

Bitbuy – Best asset protection options

Each card has different balance limits, different fee schedules and different requirements for KYC and AML, so make sure to choose the card that works best for you. For additional information on how to use the card, please visit this video link. A regulated update also protects Tron traders and investors from scammers malware and theft by hackers. Before you use that app for trading Tron, first find out when it was updated last. If you do not have an account on coinbase yet, sign up for an account first.

Yet they continue to add new offering to the exchange. I have made well over 100 support tickets to get them to take my coins out of maintenance so I can remove the coins from this exchange. They only respond with the same comments over and over It has now been 5 months and now they just ignore me.

This is more than most average traders deposit and withdraw on a daily basis. You can find an overview of the crypto assets and fiat currencies that each exchange supports in the table. Read the full review for a more detailed analysis.

Beginners Guide to Tron Day Trading In Canada

Many times this is an issue of the return being processed before the payment; sometimes, of course, the taxpayer truly owes the tax. Additionally, any partner who is filing Form 1116 can accurately complete it using Schedule K-1 for a US-only partnership. Will the IRS find some hidden treasure of unreported cryptocurrency sales? If you have one or more foreign financial accounts and you have $10,000 aggregate in those account at any time during 2019, you must file the Report of Foreign Bank and Financial Accounts (the “FBAR”). The IRS is basically telling everyone, thou shalt report your cryptocurrency gains and losses.

Paycent a crypto traded company under the symbol , a Mobile APP that’s a hybrid mobile wallet which lets users spend their digital assets globally in real time with the help of the Paycent Card. The first–and best–is that the IRS simply state that a partnerships and S-Corporations with no foreign activity or partners need not file Schedules K-2 and K-3. The reality is that the IRS does not need such partnerships (and S-Corporations) to complete the forms in order to determine whether a partner’s (or S-Corporation shareholder’s) Form was completed accurately.

Using the DeFi staking option, some coins offer a flexible option for how long you have to stake the coin. Its user interface is easy to navigate, but if you have any trouble finding what you need, the exchange offers 24/7 live chat support as well as phone and email customer support. Established in 2014, Wealthsimple is Canada’s first-ever regulated crypto trading platform. The brokerage is regulated by the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund . In addition to buying and selling cryptocurrency, you can stake your assets to earn yield. The only sincere trading market is that for BTC/ETH.

As the National Taxpayer Advocate pointed out, the IRS wants information on individuals who had reportable sales of cryptocurrency. That would be sales, exchanges, and spending; it would also include individuals who received cryptocurrency for free . The IRS wants to make sure individuals who have taxable events with cryptocurrency have reported them on their tax returns. If an investment is made, users might be asked to https://forex-review.net/ pay high initial fees before being given fake information via a falsified trading portal showing manipulated trades from the exchange. Clients may then receive harassing calls, be pressured through other means to invest more, or be induced to do so with fake returns showing extraordinary profits. If any attempt is made to withdraw funds, users may then face a series of obstacles, such as unannounced fees or fake taxes.

The opinions and views expressed in any Cryptopedia article are solely those of the author and do not reflect the opinions of Gemini or its management. The information provided on the Site is for informational purposes only, and it does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions. Please visit our Cryptopedia Site Policy to learn more. By “typosquatting,” which relies on accidental typos or domain errors entered by a user.

This exchange has potential but acts shady and scam like. There is no excuse not to allow me to withdraw my traded funds. Paycent is a financial platform powered by Texcent, a Singapore-based company dedicated to deliver fully integrated mobile applications.